hawaii capital gains tax worksheet

Hawaii State Tax Collector For more information see page 26 of the Instructions. State of Hawaii Department of Taxation PO.

Acc 330 Week 6 Part 6 Pdf 2016 Form 1040 Line 44 Qualified Dividends And Capital Gain Tax Worksheet Line 44 Keep For Your Records Before You Course Hero

Hawaii taxes capital gains at a maximum rate of 725.

. Capital Gains Tax Worksheet is used to figure. Box 3559 Honolulu Hawaii 96811-3559 PRSRT STD US. The worksheet has 27 lines and.

Allocation of capital gains and losses. A single person is exempt from capital gains tax with a gain of up to 250000 on the sale of their home and married couple with a gain of up to. Income tax rate schedules vary from 14 to 825 based on taxable income and filing status.

Fast Tax Reference Guide 2017 4 pages 227 KB 02162018. In Hawaii capital gains on. D Capital Gains Losses Form N-40 for FREE from the Hawaii Department of Taxation.

2 83 rows Capital Gains and Losses and Built-in Gains Form N-35 Rev. Locate to Hawaii all gains or losses resulting from the sale or exchange of real estate and other tangible assets which have a tax situs in Hawaii. There is good news for Hawaii residents.

Of Taxations website at taxhawaiigov or you may contact a customer service representative at. Reference sheet with Hawaii tax schedule and credits. The worksheet is part of Form 1040 which is mandatory for every individual tax filer as well as joint filers.

Of Taxations website at taxhawaiigov or you may contact a customer service representative at. Part II Long-term Gains and Losses. Download or print the 2021 Hawaii Form N-40 Sch.

You will pay either 0 15 or 20 in tax on long-term. Capital Gains Tax Worksheet is used to figure. State of Hawaii Department of Taxation PO.

808-587-4242 or 1-800-222-3229 Toll-Free. For lines 9 through 17 must be property type code CAP and the dates must show a long-term holding period or. Capital Gains Tax Worksheet is used to figure.

This capital gains tax loophole benefits the highest-income taxpayers including non-residents who profit from investing in real estate in Hawaiʻi. Hawaii State Tax Collector For more information see page 26 of the Instructions. Of Taxations website at taxhawaiigov or you may contact a customer service representative at.

In Hawaii the taxes you pay on long-term capital gains will depend on your taxable income and filing status. 808-587-4242 or 1-800-222-3229 Toll-Free. The amount of net capital gain as shown on.

808-587-4242 or 1-800-222-3229 Toll-Free. State of Hawaii Department of Taxation PO. You are able to use our Hawaii State Tax Calculator to calculate your total tax costs in the tax year 202122.

Of the taxpayers who had capital gains. Capital Gains Worksheet 2016. Hawaii Capital Gains Tax.

Qualified Dividends and Capital Gain Tax Worksheet. 83 rows Application for Extension of Time to File Hawaii Estate Tax Return or Hawaii. Individual Income Tax Chapter 235 On net incomes of individual taxpayers.

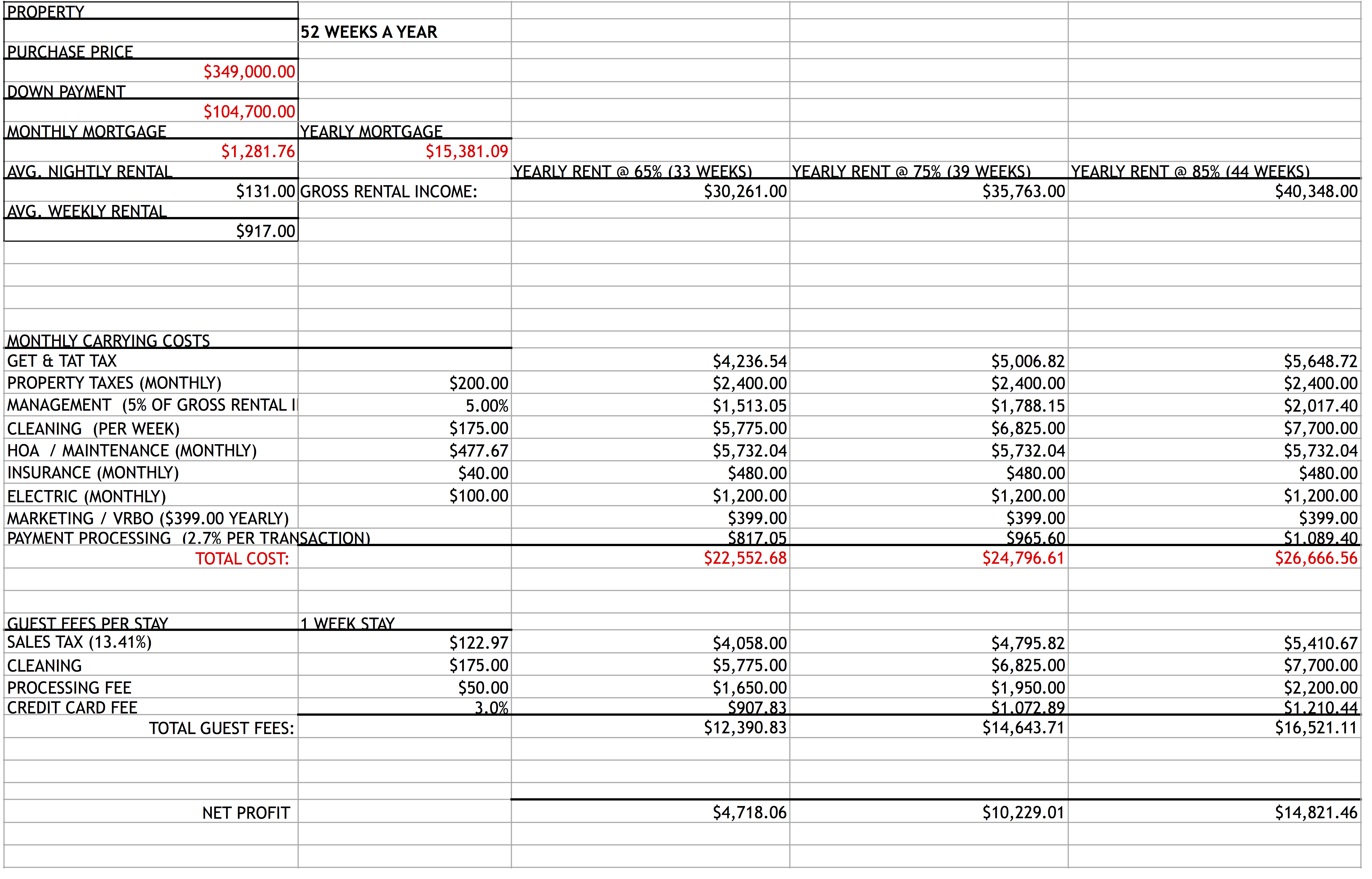

Toolkit For Purchasing Hawaii Vacation Rental Property

Qualified Dividends And Capital Gain Tax Worksheet 2016 Pdf 2016 Form 1040line 44 Qualified Dividends And Capital Gain Tax Worksheetline 44 Keep For Course Hero

Fill Free Fillable Forms For The State Of Hawaii

2022 Capital Gains Tax Calculator

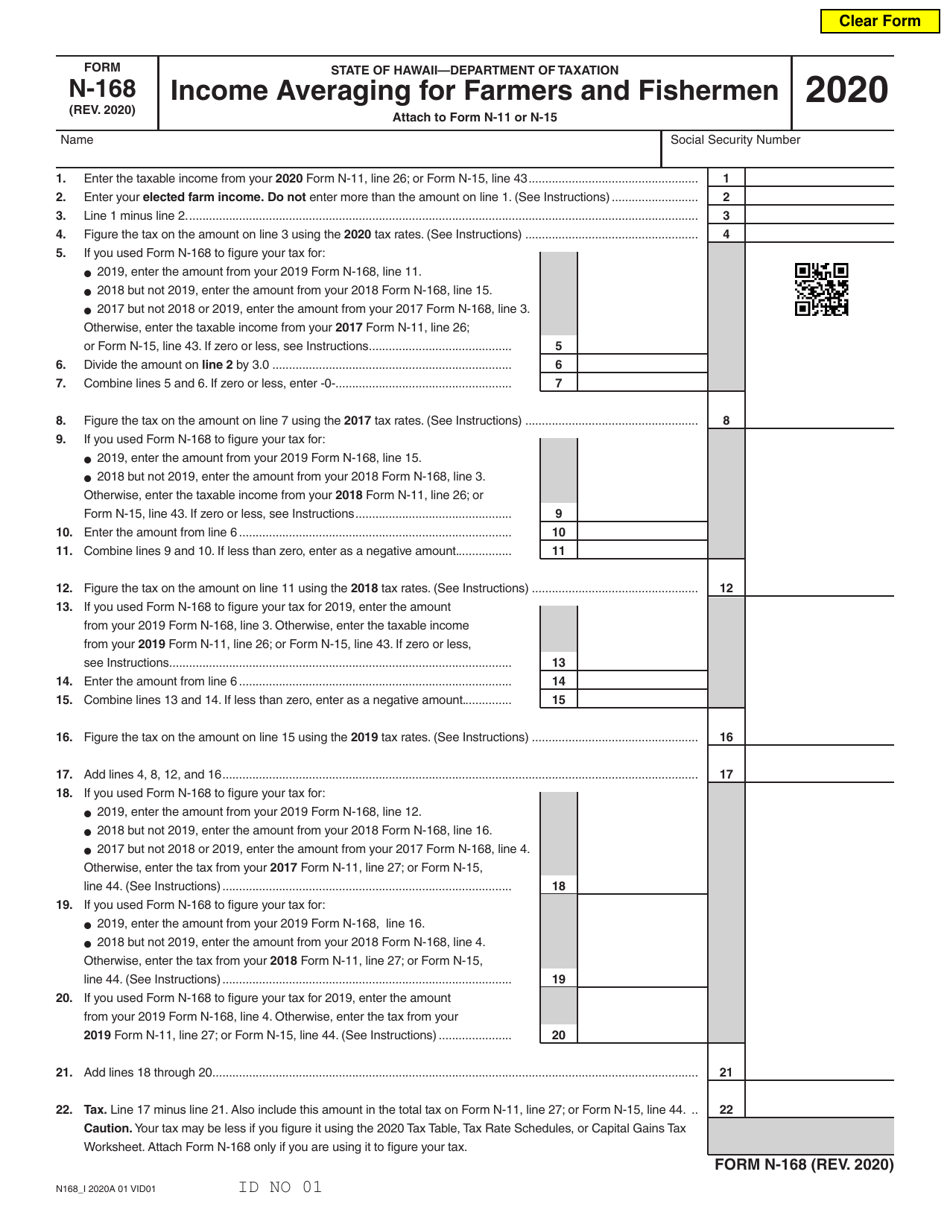

Form N 168 Download Fillable Pdf Or Fill Online Income Averaging For Farmers And Fishermen 2020 Hawaii Templateroller

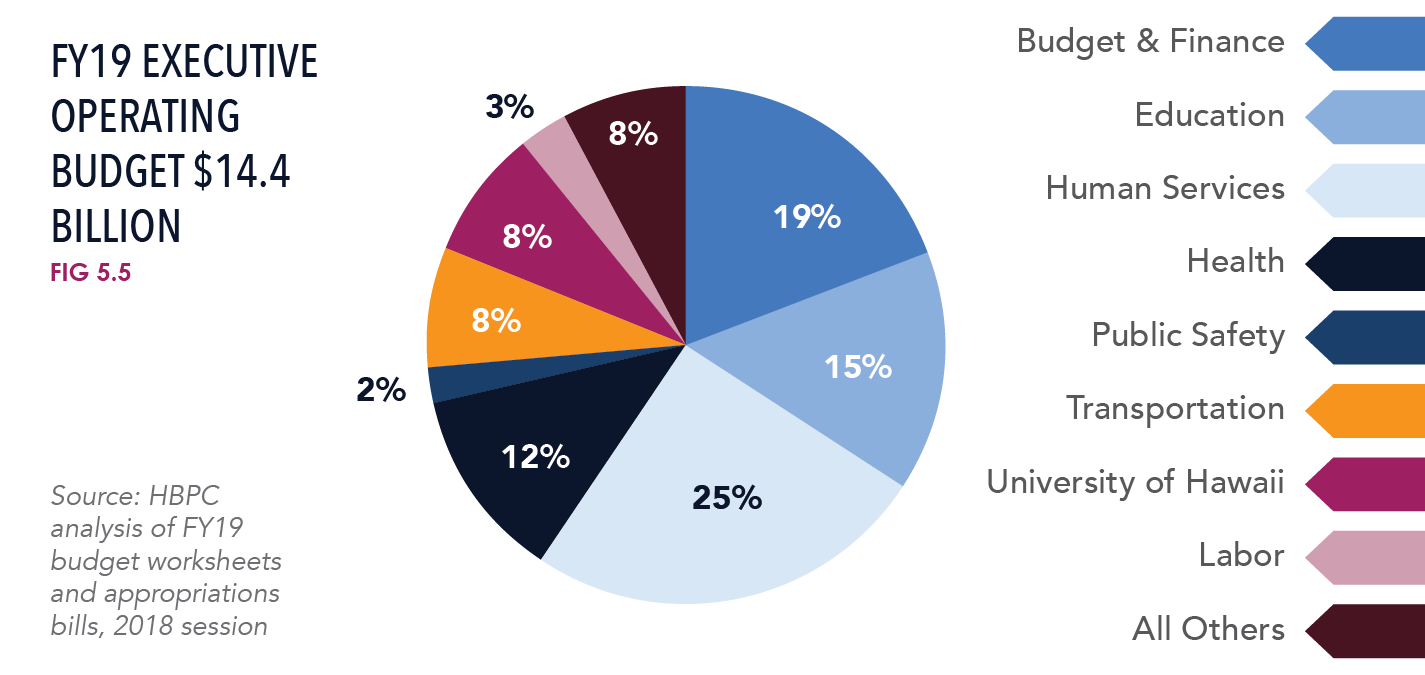

Hawaiʻi Executive Budget In Action 2019 20 Hbpc

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

State Income Tax Rates And Brackets 2021 Tax Foundation

Solved Please Help Me Find The Remaining Line Items Of A Chegg Com

Qualified Dividends And Capital Gain Tax Worksheet 2019 Fill Online Printable Fillable Blank Pdffiller

Form N 11 Fillable Individual Income Tax Return Resident Filing Federal Return

Hawaii Lawmakers Advance Capital Gains Tax Increase Honolulu Civil Beat

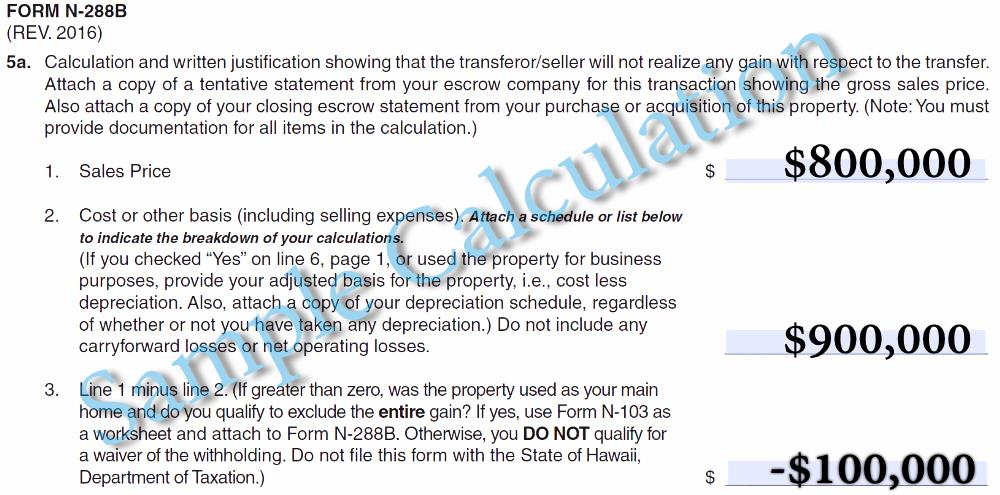

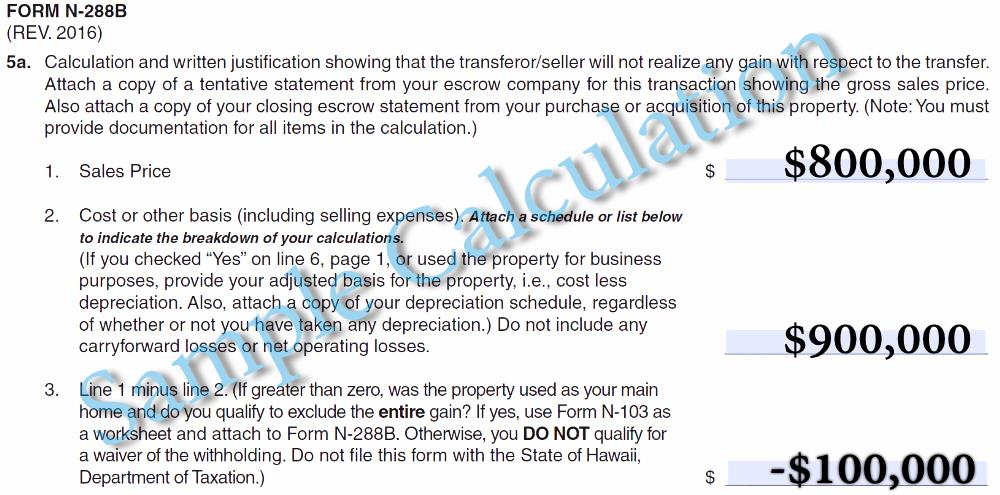

Harpta Hawaii Real Property Tax Law Selling A Home In Oahu Hi

Ab 150 California S Creative Solution To The State Local Tax Deduc Adkisson Pitet Llp

Harpta Firpta Tax Withholdings Avoid The Pitfalls

2022 Capital Gains Tax Rates Federal And State The Motley Fool

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Hawaii First Time Homebuyer Assistance Programs Bankrate

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021